ISE research head Nicola Thomas reviews member confidence in opportunities, organisational growth, Covid-19 and economic recovery throughout 2021.

As it became increasingly obvious that the Covid-19 crises was going to continue impacting the student labour market throughout 2021, ISE research started to track our member’s confidence in the future of the student labour market on a monthly basis.

Each month we asked members their confidence in: (1) the future of their organisation, (2) the state of Covid-19, (3) the opportunities for young people, and (4) the state of the economy.

We asked members to what extent they agreed with the following four statements:

- There are sufficient opportunities available for young people who are leaving education or have recently left education.

- My organisation will grow over the next three years.

- The worst of the Covid-19 crisis is over.

- The worst of the economic crisis is over.

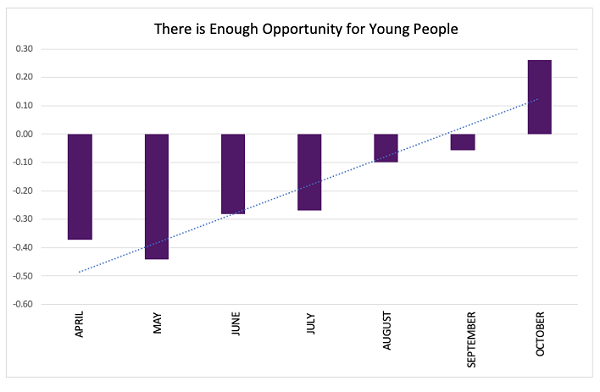

Confidence in opportunities for young people grows

Despite the economic and social impact of the pandemic, employers have continued to invest in the student labour market.

Nevertheless, as the Covid-19 crises continues to present ongoing challenges, it is more important than ever that young people who are leaving education, or have recently left education, are able to engage with sufficient opportunities and not experience unemployment, or underemployment.

Since April, the perception that there are sufficient opportunities available for young people who are leaving education, or have recently left education, has shifted.

In April and May members did not consider there to be sufficient opportunity for young people, however in June and July this perception decreased. In August and September there was a further reduction in members who detailed that there was not enough opportunity for young people. Whereas in October, there was a considerable increase in confidence, with members firmly agreeing that there is enough opportunity for young people. The trend line (the blue dotted line) highlights this shift in confidence.

The increase in confidence is likely related to findings in the ISE Student Recruitment Survey in October 2021 that showed the number of student hires increased by 12% in 2020/2021, and is expected to increase by 19% in 2021/2022.

Table 1. Graph showing the shifting confidence in the amount of opportunities for young people throughout 2021.

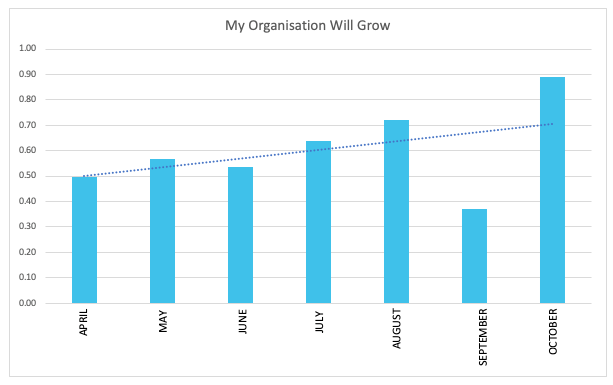

Organisational confidence grows

Confidence in organisational growth, where a company expands and continues to generate increased revenue, is important as growing companies can tap into new markets, expand products, retain and train staff, and importantly invest in further recruitment.

We asked members to what extent they had confidence that their organisation will grow over the next three years. By looking at the trend line on graph two, we can see that on average, each month members felt an increased level of confidence that their organisation will grow. In September we only asked this question to university members, which explains the outlier drop in confidence that month.

The confidence in organisational growth is an important trend as it signifies that even though our members do not consider the Covid-19 crisis to be over (table three), or the organisational crisis (table four), members are feeling confident in the ability of their organisation to withstand market challenges.

This is good news for the student labour market, as growing organisations are related to increased hiring of students and graduates.

Table 2. Graph showing the shifting confidence in the face their organisation will grow over the coming three years

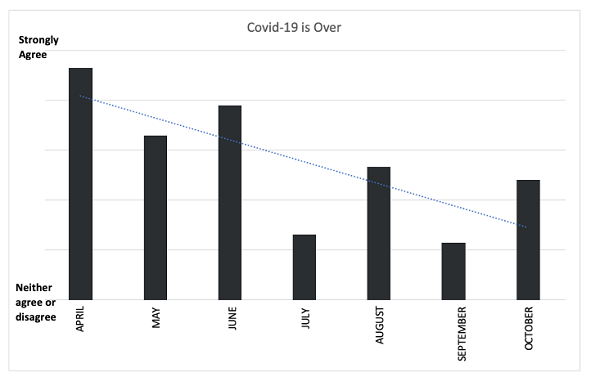

Confidence in the end of the Covid-19 crisis declining

Confidence in the belief that the worst of the Covid-19 pandemic is behind us has shifted throughout 2021.

In April, the average response indicated that members strongly agreed that Covid-19 is over. This was as vaccine uptake was increasing. However, as we can see by the trend line, the confidence in the end of the pandemic has declined steadily throughout the year.

Even though the vast majority of the UK population are now vaccinated, and an anti-viral pill has been approved for treatment in the UK, there is still a belief that pandemic is not over and will continue to influence our lives for time to come.

This is important as we start to see how the continued Covid-19 dynamic has fundamentally shifted how graduate recruitment works. Namely, under pressure from lockdowns and social distancing requirements, almost all of the employers in our 2021 recruitment survey (93%) hosted mostly virtual recruitment and selection, with employers noting this will continue into next year.

While the government has not encouraged a return to home working yet, the continued uncertainty about new variants mean that employers are still taking Covid-19 into consideration when devising recruitment strategies.

Table 3. Graph showing the shifting confidence that Covid-19 is over

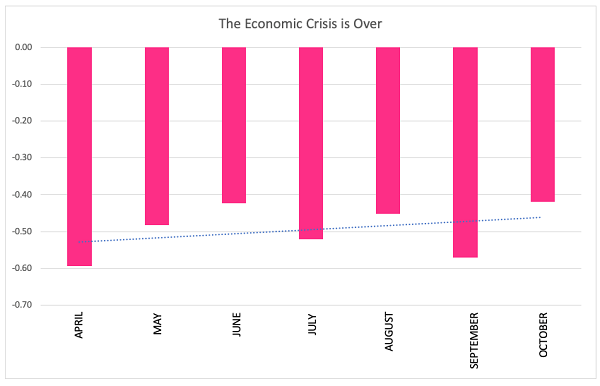

The economic crisis continues

Confidence that the economic crisis is over has been very low throughout the whole of 2021, with only a very small increase in confidence from April 2021 to October 2021.

With economic headaches from the gas crisis, to Brexit, inflation and the pandemic impacting confidence in economic recovery, few members have confidence that the economic crisis is behind us.

The government reported that the economy won’t return to pre-pandemic levels until 2022, but recent developments in the omicron variant has created further economic turbulence.

In response to the economic issues facing the UK, Rishi Sunak announced spending on skills and training will increase by £8bn, with an additional £5bn allocated to catch up funding following the disruption to education throughout the pandemic.

Table 4. Graph showing the shifting confidence in the economic crisis being over.

Conclusion

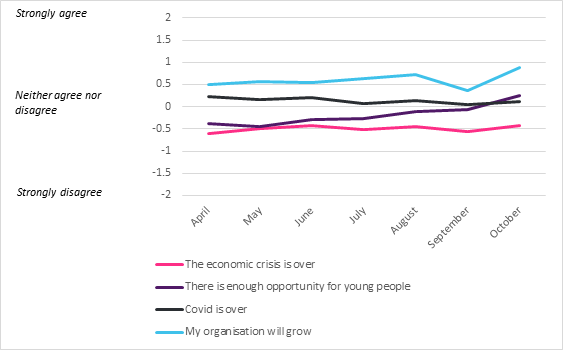

Overall, we tracked members confidence in opportunities, organisational growth, covid-19 and economic recovery.

When comparing all four areas together (graph 5), we can see that the lowest confidence is in the economic crisis. Followed by low confidence in the belief that Covid-19 is over.

Interestingly, the confidence in sufficient opportunities and organisational growth has markedly increased since April, indicating that perhaps in spite of economic hardship and a continued pandemic, businesses are continuing to overcome extenuating circumstances.

Table 5. Graph showing the shifting confidence across all four categories, throughout 2021.

0 Comments