Robert, founder of the Apprentice Decent Wage Pledge, is the keynote at ISE’s forthcoming Apprenticeship Conference. He explains what the National Living Wage increases mean for apprenticeships and what employers can do.

In April 2024 the National Living Wage will change to effect those in employment over the age of 21, increasing from £10.42 to £11.44 per hour. This can amount to an annual pay rise of approx £1,963 to a full-time worker (37 hours a week). The rises apply to all age groups as well as the apprentice wage.

Increases in the cost of living over the last year are putting pressures on to the individual. This can be more impactful on those who receive a lower wage such as apprentices.

The changes

Under the Apprenticeship Regulations Apprentices can be paid the apprenticeship wage rate for their first year and if under 18 for subsequent years also. If they are aged 19 or over however, they can only be paid the apprenticeship wage rate for the first year and then must be paid the appropriate wage rates for their ages.

The new rules mean that, depending on an apprentice’s age, there could be a large increase in wages after the first year. Read more government information on the minimum wage rates.

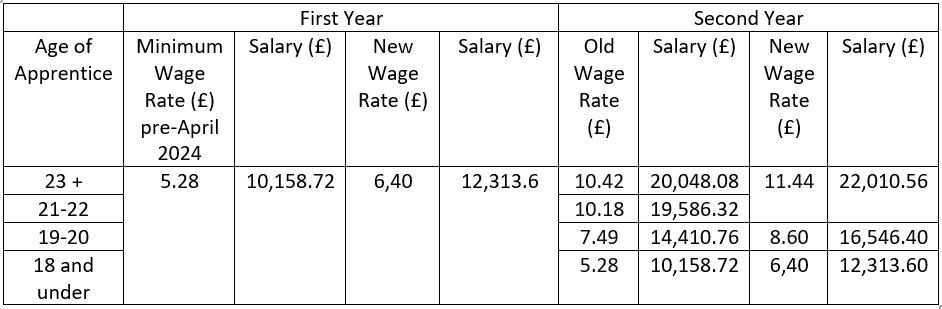

The table below demonstrates the possible differences in wages between a first and second year apprentice at various ages under the new bandings. This is based on an apprentice doing 37 hours a week 52 week a year.

Note that a second-year apprentice who is 18 still receives the apprenticeship wage and is not entitled to the normal 18–20 pay bracket. Also, from 2024 the age bracket will change to age 21 plus from 23 plus for the living wage.

These changes bring risks and challenges for employers.

Unwillingness to employ older apprentices

The changes may lead to some employers being less inclined to employ older apprentices due to the increase in their wages during the second and subsequent years of the programme.

This may be further compiled with the added funding that an employer gets for employing an apprentice who is under 19. It is increasingly more attractive to hire an apprentice under 19.

A supplementary risk, is that apprentices may suddenly have a lot more disposable income and so may require extra support around issues such as substance abuse, gambling or extravagant spending.

There may also be an impact on using apprenticeships to reskill people changing their careers.

For example, a foundation degree graduate (20 years old) without an industrial placement may want to change career path but find it difficult to find an apprenticeship as in their second year they would cost more than £4,000.

Alternatively, a former industrial worker with 10 years’ experience and over 21 may wish to retrain as a hairdresser due to a medical reason but find it hard to gain a place on an apprenticeship as they would cost £10,000 more to employee in their second year than an 18-year-old.

We may find more people inappropriately trained for the jobs that are needed or that they wish to carry out and who are too expensive to retrain when compared to someone younger.

This could lead to a large number of unemployed middle generation individuals who are finding it hard to gain the skills they need to find work.

Employers susceptible to large wage increases

The changes will affect nearly all current programmes with apprentices over the age of 19. As employers are responsible for wages and unable to use any transferred funds from the levy, SMEs may be more affected, unable to absorb increased cost.

We may find apprentices being let go and employers less likely to repeat the process of employing apprentices.

Miss-matched apprenticeship and minimum wage pay bands

The miss-match between apprenticeship and minimum wage pay bands for 18-year-olds in the second year of their apprenticeship may lead to them being tempted away for a job that pays more per hour, but that may fail to provide them with the defined development received on an apprenticeship. This can be more pronounced if the individual has a dependent or needs to pay their own rent.

Employers should be prepared to clearly demonstrate the difference in jobs and the benefits of apprenticeships.

Perceived unfairness in wages

The rules could mean that two apprentices who are at the same point in their development are paid drastically different wages based solely on their age.

This may lead to tensions between apprentices and feelings of unfairness that could affect team morale and productivity as they are unhappy and less motivated that a colleague is being paid more money than them for the same role.

Planning for wage increases and the risks of minimum wage bandings

Proper planning and the implementation of a fixed wage progression plan will help both managers and apprentices understand salary by year and avoid any surprises with second year wage increases.

It may also be possible to base wages on internal pay scales (if above the minimum), this would limit the risk from paying individuals different amounts based on their age.

Some companies take this principle a step further and pay all of their employees, including second year apprentices, at least the National Living Wage irrespective of age.

This can be costly, but lessens the risk factors explained above. This can also lead to a more diverse workforce able to develop the skills needed for the local area and can help address any major retraining needed in areas where industry types have changed.

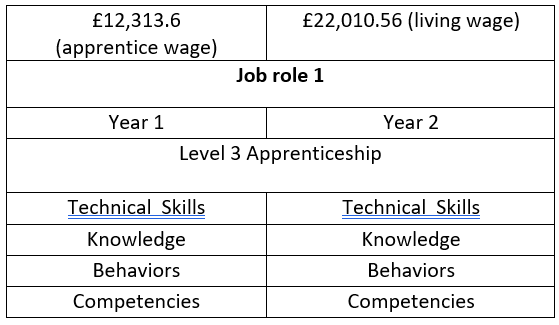

The chart below shows an example of a fixed wage increase over one year linked to the National Living Wage. It shows apprentices what they should learn and accomplish each year. It enables employers to review performance against competencies, clearly demonstrating why they should be paid the same wages or why there are any differences. This is useful for both apprentices and stakeholders.

Please note this is based on the minimum apprenticeship wage, it does not take into consideration local costs of living and individual needs. Changes to bandings can happen multiple times a year so employers should ensure they have assigned an individual to monitor the situation.

Changes to the National Living Wage come with risks and challenges for employers. However, when they are appropriately considered and planned for, they can enable policies and practices that lead to a more inclusive and fairer workforce.

Hear more from Robert including award-winning work in delivering social justice through apprenticeships at the ISE Apprenticeship Conference taking place Tuesday 20 February 2024.

0 Comments